Here's What Lenders Need to Know

Obtaining tax return transcripts directly from the IRS is required for certain loan types. While this process can be burdensome, it allows lenders to verify borrower income, financial history, as well as identify tax liabilities. Further, obtaining tax transcripts from the IRS protects against fraud, as the information is obtained directly from the IRS.

While the use of one-time tax return transcripts is standard practice for underwriting, the lesser-known practice of obtaining ongoing tax return transcripts serves a critical role in portfolio management.

What are Tax Return Transcripts?

Tax return transcripts obtained from the IRS provide source of financial information including revenue, income, tax liabilities, and tax filing statuses for individuals as well as businesses that can be used to confirm information provided by loan applicants. Tax return transcripts are typically used by lenders to assess loan applicants’ financial stability before approving a loan.

The IRS grants access to two primary forms of tax transcripts: one-time and ongoing.

One-Time Tax Return Transcripts: A Snapshot of Financial Health

- Reduced strain on loan applicant: Lenders can reduce the quantity of information requested from loan applicants to evaluate their eligibility for a loan by instead using IRS tax transcript information to obtain the data they need or verify the information provided by a loan applicant.

- Fast verification: Tax transcripts provide financial information in a concise form, allowing lenders to quickly assess a snapshot of a loan applicant’s financial health.

- Simple process: As a single request, lenders pay a single fee to obtain the tax transcript.

Despite these benefits, one-time transcripts have a major limitation: their limited view. Because one-time transcripts provide a one-time snapshot of a loan applicant’s payment history and financial standing, lenders must base decisions around the current status of a loan applicant’s financial report. One-time transcripts do not allow lenders to monitor financial changes over time after a loan applicant has been given a loan and needs to be monitored.

Ongoing Tax Transcripts: Continuous Financial Monitoring

Unlike one-time tax transcripts, ongoing tax transcripts provide long-term, continuous visibility into a borrower’s finances. For lenders offering access to long-term financing solutions, like SBA loans, ongoing tax transcripts provide critical insights into borrowers’ financial stability over time.

Ongoing tax transcripts are utilized for loan-servicing to monitor the status of borrowers’ ability to repay their loan obligations. As a result, ongoing transcripts have numerous benefits for lenders:

- Updated financial data: Lenders can consistently view financial updates, ensuring they have access to the most recent tax filings to evaluate potential portfolio risk.

- Enhanced risk management: With continuous financial updates, lenders can mitigate risk as it arises and before loan payments are late. While this is valuable for all lenders, it is particularly useful for loans to self-employed professionals or business owners who may be more prone to financial fluctuations.

- Maintaining compliance: Lenders can streamline their servicing workflows by obtaining up to date, verified financial data throughout the term of the loan. With automated reporting of the latest information, lenders can eliminate manual outreach and collection processes to obtain new financial information from borrowers.

- Reduced ongoing burden for borrowers: Ongoing transcripts allow lenders to obtain the critical information they need, enabling borrowers to maintain focus on their business operations instead of aggregating and reporting new financial data.

Choosing the Best Transcript Option for your Loan Team

Determining which transcript type is most appropriate for your loans is primarily dependent on the longevity of the loan term. For lenders with very short-term financing, a one-time transcript may be sufficient to evaluate risk and repayment. However, lenders with long-term financing or financing over an expectedly turbulent economic period, will benefit from ongoing transcripts to continue to monitor risk.

In most cases, lenders may benefit from a combination of both one-time and ongoing transcripts. One time access may be useful in determining eligibility for a loan, while ongoing transcripts are suitable for those loans that are funded.

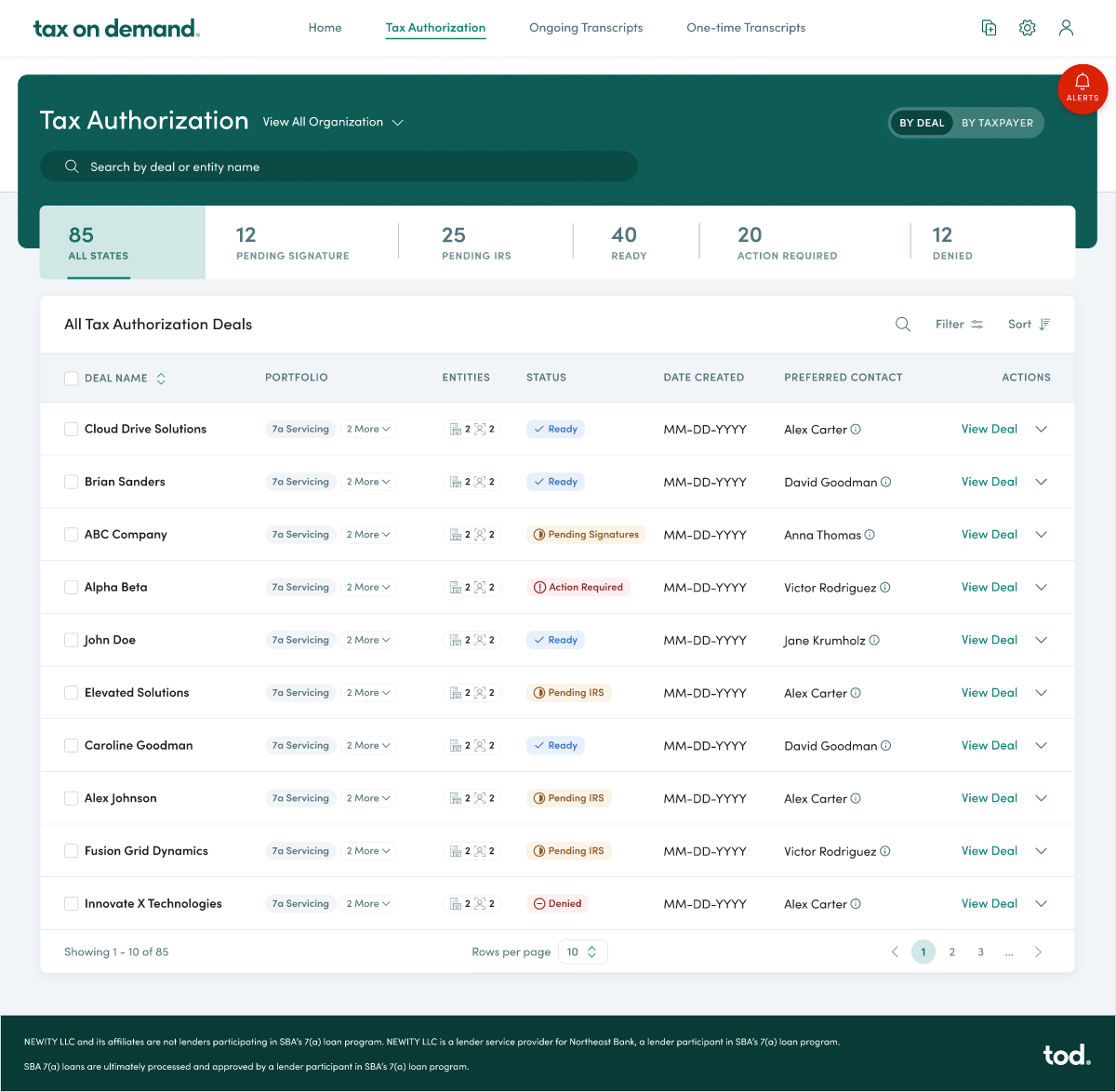

How Tax on Demand Simplifies the Transcript Process

Tax On Demand provides fast, secure access to one-time and ongoing tax transcripts, ensuring lenders receive accurate and reliable financial information. As a reliable solution with user-friendly, lender-forward features, Tax on Demand can help lenders retrieve transcripts faster, reduce portfolio risk, and scale their underwriting & servicing.

To learn more about Tax on Demand and discuss solutions for your team, contact the partnership team today.