We are

Tax on Demand or TOD offers seamless access to IRS tax transcripts for lenders through our technology-powered platform. As the partner to the #1 facilitator of SBA 7(a) loans by volume, we access over 1,500 transcripts per month, discovering more than 100 undisclosed tax liabilities per month, and saving more than 400 hours of personnel work per week.

Our platform empowers lenders to scale their origination and servicing capacity by delivering timely, accurate, and reliable tax data. We constructed TOD with security and efficiency at its core. Each TOD feature aims to scale lenders’ operations without increasing overhead or personnel work hours while mitigating risk.

Our Services

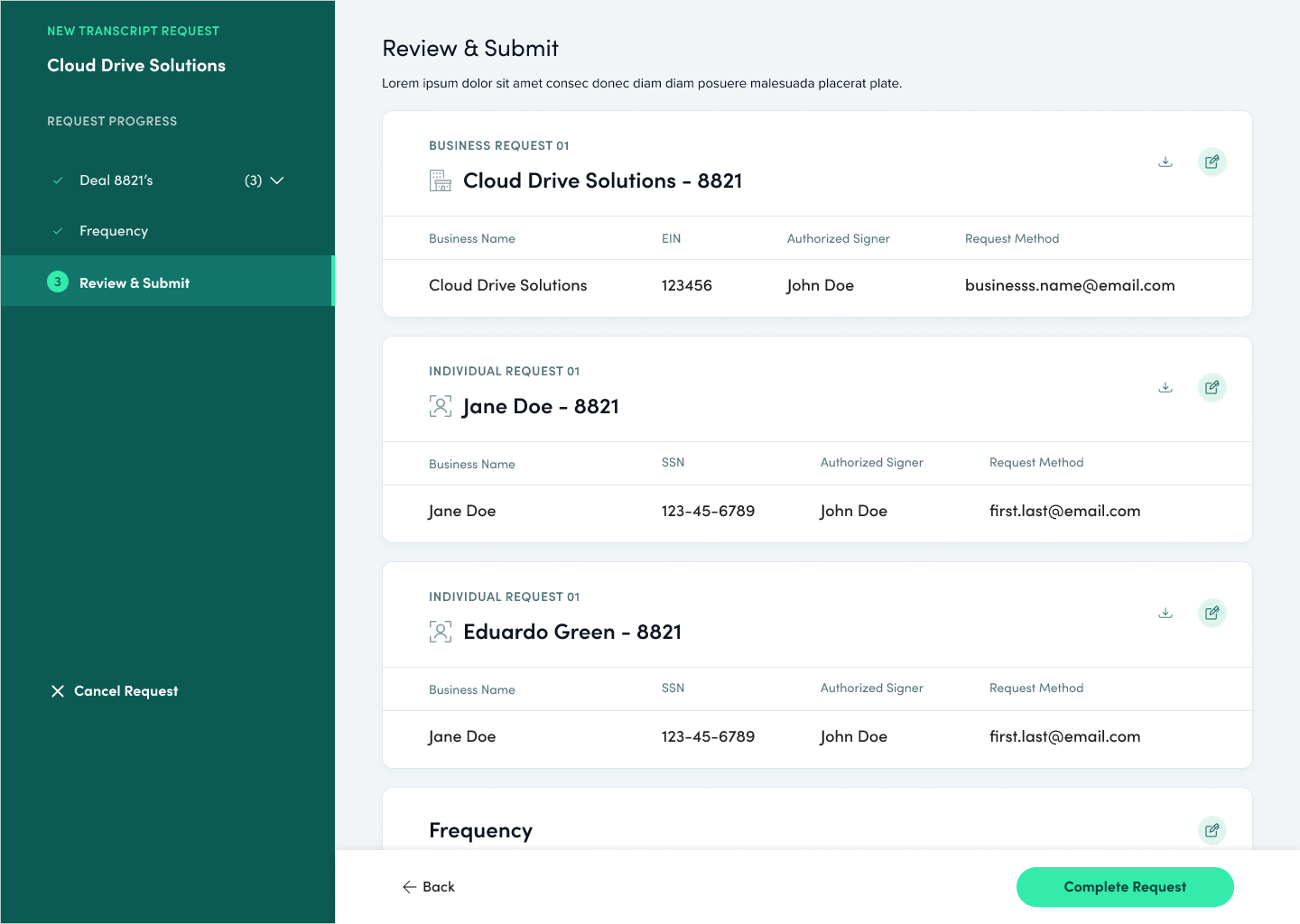

TOD provides a technology-driven solution for lenders to access one-time and on-going tax transcripts. With a secure platform, user friendly interface, and intuitive dashboards, TOD brings a lender-oriented experience for its users.

With a primary focus of streamlining the tax transcript process, TOD can create origination and servicing efficiencies for lenders of all types. Our system quickly makes relevant information accessible to the user, enabling effective management for loan portfolio origination and servicing.

At Tax on Demand, we developed features specialized for individuals who are regularly tasked with gathering and analyzing tax transcripts from the IRS. For example:

TOD’s system notifies lenders when they have lost access to borrowers’ information due to an IRS Centralized Authorization File (CAF) failure. Lenders no longer need to open individual taxpayer files to check last-accessed transcript dates to be sure they are viewing live, accurate tax data. Coupling accurate information with saved time, loan teams find dual efficiencies in this single alert feature.

Additionally, lenders can be alerted to the appearance of new tax liabilities, avoiding the need to open specific tax profiles to discover the change, saving time in daily portfolio maintenance. With awareness of the new tax liability, lenders can analyze its potential impact on the loan and the borrower’s ability to repay. With real-time tax alerts, lenders create the opportunity to proactively mitigate loan and portfolio risk.

Further, TOD’s system is easy to navigate with search and filter functions by individual taxpayer, business names, or assigned loan representatives, allowing for quick location of information. This function allows users to quickly locate information and easily identify associations. For large loan portfolios, this organization is particularly helpful, should new tax liabilities arise for an individual taxpayer with multiple business loans.

As a full-service solution, TOD manages the entire tax transcript process. This includes coordination, collection, and transmission of borrower signatures, transcript requests from the IRS on varying timelines, as well as secure storage and organization of transcripts. Allowing TOD to handle the transcript services required by your underwriting procedures or those outlined in the Small Business Administration’s (SBA) Standard Operating Procedures, permits your team to focus on top initiatives within your lending department.

How  Supports Lenders

Supports Lenders

Tax on Demand is a one-stop solution for one-time transcripts and ongoing tax monitoring.

Underwriting Support

TOD’s easy-to-use interface allows origination teams to scale their operations. By receiving tax transcripts quickly, lenders can verify prospective borrowers’ revenue, income, tax liabilities, and tax filing status. This eliminates the need for lengthy cross-checking and tax-return review, increasing the speed and efficiency of underwriting. Further, Tax on Demand helps lenders reduce fraud risk and uninformed lending decisions by evaluating information sourced directly from the IRS. In total, tod’s services can quickly create lift for lenders to scale their operations.

Servicing Support

With ongoing tax monitoring, Tax on Demand alerts lenders to changes in their borrowers’ tax profiles. This notification system enables lenders to manage risk before it impacts the portfolio. With easy system exports, servicing teams can maintain servicing requirements and reporting without revisiting original underwriting files or contacting borrowers for updating tax information.

Enhanced Borrower Experience

With Tax on Demand’s built-in systems, the platform also enhances borrowers’ experience with their lender. With a borrower’s signature on IRS Form 8821, lenders can readily access borrowers’ information. This IRS data feed enables lenders to easily obtain borrower tax transcripts to verify financial standing without requiring borrower involvement for at least three years.

Beyond reducing the quantity of documents required from borrowers, lenders can stop chasing borrowers for updated information or complete files. tod’s continuous transmission of tax information eliminates the burdens for both lenders and borrowers alike. Lenders can cease unnecessary back and forth communication that can degrade borrowers’ experience and incite frustration. By reducing borrower-required input, lenders are free from tracking requests and borrowers can fully focus on their business.

Future  Features

Features

As a financial technology company, we are continuously improving our services at TOD. With upcoming API integrations, Tax on Demand will be able to embed within lenders’ existing workflows such as loan origination systems, loan servicing systems, and customer relationship management tools. New smart alerts will support lending teams in viewing information that is most relevant to their needs. Future custom reporting will allow lenders to automatically populate their standardized forms, eliminating time-consuming data-entry. While these are just a preview of the many features to come, TOD is far from its evolution as a tax transcript provider.

How to Learn More About

If you’d like to learn more about TOD and our simple onboarding process, please contact our partnership team. They look forward to learning about your process and discussing a solution for your team.